Frequently Asked Questions

General

What stage companies are a fit?

TBD Angels invests in early-stage ventures who would benefit from the advice and connections of our investor members. The typical investment is in the range of $75K-$250K.Is there a geographic focus?

TBD Angels membership covers over 20 US states and 6 international countries, and most investments will be in the United States.What is the overall process?

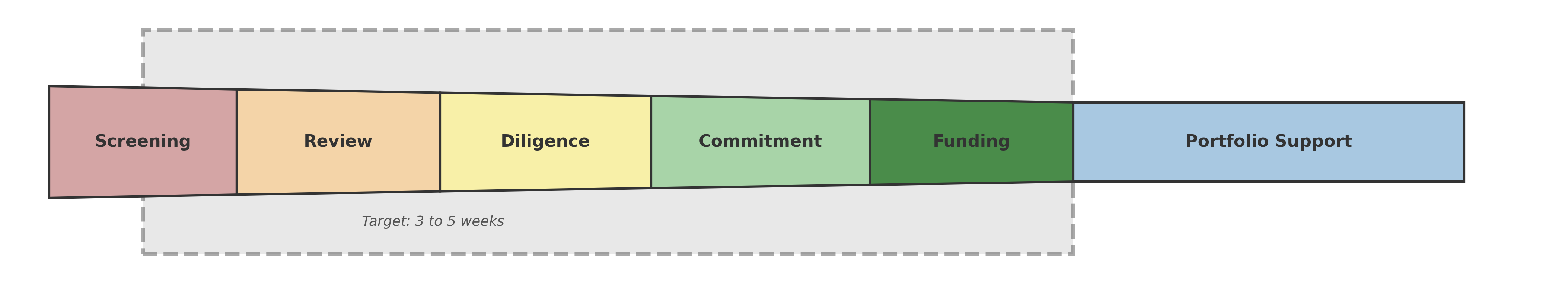

Our deal flow is member-sourced, with companies partnering with a TBD Angels member who sponsors the deal and provides a link to the company for deal setup and submission to the group. We strive for one week to express interest and a total of four to six weeks to complete the process. After initial screening, members will vote whether or not to see the pitch. Assuming sufficient votes, the deal will move to evaluation and the entrepreneur will pitch and answer questions over Zoom.

Assuming sufficient post-pitch interest, further evaluation and diligence will take place at that point. The deal will then move to accepting commitments from interested members and then will move to invest via SPV. Members “opt in” by deal – this is not a fund/LP model.

How does TBD Angels work with their portfolio companies?

The members of TBD Angels have a passion for helping entrepreneurs and their teams in varying ways and each have their own style of working with companies, ranging from responding to investor update emails, to referring strong candidates to the team, collaborating on product roadmap and strategy, making connections with partners and customers, to helping raise the next round.After an investment, can entrepreneurs contact one of the TBD Angels individually?

The deal lead will make direct introductions between relevant, interested investors and the company founder(s). While a big part of the group's value-add is the network and experiences, TBD Angels respects the privacy of its investor members.For Entrepreneurs

What are the benefits of investment from TBD Angels?

- Investment from active, highly connected operators and experts

- Founder-friendly & quick process (target is four to six weeks)

- One line-item on your cap table

Where does deal flow come from?

Potential investments come multiple sources:- Existing members: since TBD Angels members have a deep set of connections (e.g., other VCs/angels entrepreneurs, and local organizations) and have good deal flow from our own networks

- Close VCs in our networks

How do I pitch TBD Angels/submit a deal for consideration?

Find someone you know within the group to let them know about your company. If they are willing to sponsor the deal, they will provide a link for deal setup and sharing with TBD Angels via All Stage.Who attends the pitches?

All TBD Angels members are welcome to attend pitches (all video-conference at the moment). The deal lead is the point person and will sync up with the entrepreneur on scheduling a ~45 minute pitch meeting and demo (if applicable) with Q&A. In this meeting, the deal lead is required to attend and any angels that are interested and/or would add value in evaluating the startup.We also record pitch sessions, to provide all members access to information critical for decision-making.

Is there an investment committee that determines whether to invest in a deal?

Not in the traditional sense. After the pitch session, the deal lead will assess interest from the group, ask members who attended/watched the pitch to share feedback, and may pose additional questions to the entrepreneur. The deal lead may be joined by two to three other members who can evaluate the deal and ask questions. The results of that dialogue will be shared back with the group.Ultimately, each TBD Angels member makes their own independent decision whether to make an investment commitment.

Can my individual angels join the TBD investment?

TBD Angels supports investments from non-members who have a relationship with a member or with the company. Founders can work with their TBD Angels contact to invite these investors into the deal through the TBD Angels portal, where they can review the opportunity, register a commitment, and access the SPV.For Investors

What are the benefits of joining TBD Angels?

- Large and robust network of peers

- Opportunity to leverage each other’s knowledge and sharpen investing skills

- Small minimum check size ($2.5K)

- Broad deal flow and portfolio diversification

Is TBD Angels open to debt and equity investments?

Yes, we are open to convertible notes, SAFEs, and equity (priced rounds).Can I personally invest additional capital alongside a deal?

Yes, you are free to individually invest as an angel investor in deals that we accept and ones that we do not.Is there a minimum investment per deal?

Yes. If you choose to invest in a deal, the minimum investment is $2.5K per member. Each investor member can opt in or out to every deal.For efficiency, we aggregate the members’ investments in a deal through a special purpose vehicle (SPV) with the intent of hitting a minimum of $75K for the deal.

What's the expected involvement with portfolio companies after they’re funded?

As operators with varying domain and functional experience, members can contribute meaningfully with unique insights or set of connections. Since TBD Angels members are entrepreneur-types rather than investor-types, a big part of the value-add and appeal will come from our direct involvement rather than a "fire and forget.” It will ultimately be up to the entrepreneurs, but we’ll want to be available to be hands-on and have active dialogue with the startups.How do I strengthen my angel investor experience?

The best way to sharpen your angel investing experience is to attend pitches where you can benefit from hearing the Q&A posed by your fellow members and participating.In addition, you can take on the role of deal lead for an investment. Don’t worry if you don’t have experience doing so - we can walk you through the process and ensure you’re successful. As deal lead, you’ll get an inside look into how to best work with entrepreneurs, probe critically on the upside/downsides of a deal, write a compelling investment brief, and drum up excitement and support for a deal.

Should I lead a deal?

Leading a deal at TBD Angels provides you an opportunity to work with an entrepreneur more closely, take leadership as the point person for the investment, and optionally benefit from carried interest on an investment. The responsibility does require time and thoughtfulness. As the deal lead, you are representing both the entrepreneur and TBD Angels. TBD Angels allows for multiple deal leads, so you can team up with a colleague to share the role.As deal lead, your key responsibilities consist of involvement at the following stages:

- Sourcing: reviewing the company’s deal, facilitating discussions and meetings between entrepreneurs and interested angels

- Investment: creating/distributing an investment brief, exposing pros and cons, recommending the deal, drumming up momentum for the deal, and keeping the company apprised on progress

- Post-Investment: encouraging the company to provide periodic updates (3-12x/year) to the rest of the group, being point-person between TBD Angels and the company

Do deal leads earn carried interest?

As deal lead, you have the option to elect up to 3% carried interest in the investment. Since TBD Angels members are active, this amount is purposely below the typical 20% for passive limited partners in a fund..Membership Criteria

What are the criteria to become a member of TBD Angels?

In order to provide high value to entrepreneurs, our members fit the criteria below. The main idea is to ensure our members have deep expertise and willingness to provide high value to entrepreneurs.- Experienced startup founder, current operator, executive, or industry expert who can effectively evaluate startups and provide entrepreneurs with guidance based on their expertise. We are not at this time looking for financial only members like bankers, venture capitalists, etc.

- Expertise in their fields: Our members have a strong track record of impact in their respective fields, such as launching globally scaled products, driving industry-changing innovations, or pioneering new business models. Expertise in their field helps them assess product-market fit, business viability, and long-term scalability of our startups and to guide them.

- Members are to be confirmed after an evaluation of their accomplishments and expertise and a live interview by experts in their field to ensure they can contribute meaningfully to our entrepreneurs and our community.

- Eager to engage with fellow angels and entrepreneurs: We’re best when our members actively provide unique insights into startups requesting funding and/or share expertise after the portfolio company is funded.

- Members are expected to be available to answer questions, provide support, and make connections for our portfolio of companies. This is the way we tip the scales in our favor and increase our chances of a positive outcome. This will likely mean the occasional call or participation in Slack.